top of page

Welcome to the Bridge Journal

Disclaimer: The following articles are for general information only and do not constitute personalised investment advice. Any regulated financial advice is provided under the authorisation of Network Financial Services (NFS) in accordance with MiFID II and IDD requirements.

Portugal tax update (2026) – what UK expats should know

If you’re a UK national living in Portugal (or planning the move), the 2026 tax year is broadly a ‘steady as she goes’ update: a small easing of Portuguese income-tax bands, no headline change to investment tax rates, and ongoing planning opportunities around property and estate structuring. Quick headlines Portuguese IRS income-tax brackets increased by 3.51% and rates reduced by 0.3 percentage points for the 2nd–5th bands. Solidarity surcharge remains 2.5% (EUR 80,000–250,0

Steve Thompson

2 days ago3 min read

Leaving the UK isn’t the end of the story

When many families leave the UK, it feels like a line has been drawn. Homes are sold or let, residency changes and life moves on. And with that comes a natural assumption: “Our UK tax exposure is behind us.” In practice, that’s rarely the case. Over the past year, I’ve seen a growing pattern among internationally mobile families: the biggest risks don’t arise when you leave the UK, they surface later, sometimes years later, and often at the worst possible time. A client sto

Steve Thompson

6 days ago4 min read

UK tax “exit charges”: the hidden costs of leaving the UK

And the “Portugal tax resident impact”. The UK still doesn’t charge a single, formal “exit tax” when you leave. But the practical reality is that moving abroad can trigger loss of reliefs , timing traps , and anti-avoidance rules that create exit-style costs, often at the exact moment you’re trying to simplify life. This guide focuses on the UK side and (crucially) what changes once you’re Portuguese tax resident . Losing UK allowances and planning headroom What changes whe

Steve Thompson

Feb 87 min read

The UK’s New Foreign Income & Gains (FIG) Regime — and Why It Matters (Alongside the New IHT Rules)

Steve Thompson, Financial Planner in Portugal February 3, 2026 From 6 April 2025 , the UK introduced the Foreign Income and Gains (FIG) regime. It replaced the old Remittance Basis and is designed to be simpler for people moving to the UK after spending a long period abroad . At the same time, the UK also changed the way Inheritance Tax (IHT) works for internationally mobile families, moving from a domicile-based approach to a clearer residence-led framework. This

Steve Thompson

Feb 34 min read

Strategic financial planning for life in Portugal in 2026 and beyond

Is your plan still fit for purpose in Portugal, and for the people you’ll one day leave it to? If you’ve been living in Portugal for a while (or you’ve recently made the move), it’s easy for financial planning to become a collection of “good decisions made at different times”. A pension here. Some old UK investments there. A Portuguese will. A tax conversation with an accountant. A separate conversation with a lawyer. Individually, each piece might be sensible. But if they’re

Steve Thompson

Jan 243 min read

Offshore Investments: Smart Strategy or Silent Leak?

Steve Thompson, Financial Planner in Portugal Helping successful families with wealth to protect, move to Portugal with clarity, confidence, and tax-smart planning | Published author | Founder/CEO | Chartered Fellow FCSI | Ultimate UK→PT Relocation Guide coming 🔜 January 2, 2026 Two real ways people do it, and why the “same” investment can produce very different results. If you’re a UK expat (or you’ve lived in more than one country), chances are your money is a bit… spread

Steve Thompson

Jan 23 min read

Selling your UK property from Portugal? Here’s the tax twist nobody warned you about

Steve Thompson , Founder, Atlas Bridge Wealth | Specialist advice for individuals and families moving to, living in, or leaving Portugal 🇵🇹 December 4, 2025 If you’re a Brit living in Portugal and still own a property back in the UK, whether it’s your old family home, a buy-to-let, or something you hung onto “just in case”, this might be one of the most important things you read this year. Because there’s a quiet little tax trap that almost nobody talks about. And occasiona

Steve Thompson

Dec 30, 20254 min read

The benefits of reinvesting property sale into a life assurance plan

Steve Thompson , Founder & CEO @ ATLAS BRIDGE WEALTH | Boutique cross-border financial advisory | Europe & Middle East | Chartered Fellow CISI® November 20, 2025 I'm going to tell you a story.... Recently I met a British couple in their mid-60s who’ve lived in Portugal for a number of years. Let’s call them Chris & Margaret . Their kids had moved out years ago, the house felt too big, and they wanted to simplify life. So they made a big decision: Sell their main home in the

Steve Thompson

Dec 30, 20253 min read

Tax in Portugal: The Complete Guide for Expats

Portugal’s tax regime affecting expats has gone through recent changes. Read on for more information on what to expect from taxes as an expat in Portugal. Disclaimer : This guide is for informational purposes only and does not constitute legal or tax advice. Anyone acting on this without tailored professional counsel does so at their own risk. Why Portugal? Portugal has become a top destination for international professionals, retirees, and digital nomads. With a high quality

Steve Thompson

Dec 30, 20259 min read

How UK pensions are taxed in Portugal

Welcome to the Atlas Bridge Wealth guide to pension planning in Portugal - 2025. This guide explains how UK pensions are taxed when you become resident in Portugal. It breaks down the treatment of State, occupational, government, and personal pensions under the UK–Portugal Double Taxation Agreement, including the powerful 85/15 Category H rule that can reduce effective tax to as little as 3–4%. It also covers the NT (No Tax) code process, lump-sum withdrawals, voluntary UK Na

Steve Thompson

Dec 30, 20257 min read

Leaving the UK for Portugal? The tax “exit costs” people don’t see coming.

Steve Thompson, cross-border financial planner in Portugal Helping UK families with £1m+ assets move to Portugal with clarity, confidence, and tax-smart planning | Published author | Founder & CEO | Chartered Fellow FCSI | “Steve helped us avoid costly mistakes during our move.” December 17, 2025 Moving abroad is exciting… until you realise the UK doesn’t need a formal “exit tax” to make your departure expensive. In reality, the cost often shows up in quieter ways: reliefs yo

Steve Thompson

Dec 17, 20254 min read

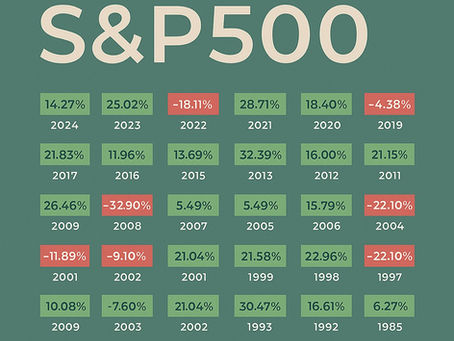

The S&P 500: A century of lessons in patience, perspective, and playing the long game...

Steve Thompson , Founder, Atlas Bridge Wealth | Specialist advice for individuals and families moving to, living in, or leaving Portugal 🇵🇹 December 7, 2025 Whenever markets wobble, someone will always ask me the same question: “Steve… is now really the right time to be investing?” And almost every time, I point them back to one place: the S&P 500 — the clearest long-term mirror of the U.S. economy, and arguably the best teacher in investing. But to really understand why t

Steve Thompson

Dec 7, 20255 min read

The expat playbook: 10 lessons that save you stress, tax & money

Steve Thompson - Founder @ Atlas Bridge Wealth | Specialist advice for individuals and families moving to, living in, or leaving Portugal 🇵🇹 December 2, 2025 When people talk about moving abroad, they’ll tell you about the sunshine, the lifestyle, the golf, the slower pace of life. What they won’t tell you — until you’re already knee-deep in it — is just how messy your financial life becomes the moment you become an expat. Almost every week I speak to someone who says a

Steve Thompson

Dec 2, 20255 min read

The UK’s new 10-Year tail: how to protect your wealth overseas

By Steve Thompson, Founder & CEO @ Atlas Bridge Wealth | Guiding families and individuals in Portugal November 29, 2025 Every week I speak to British families who’ve made the move abroad, or are planning to. Portugal, Spain, Malta, Dubai… the destinations differ, but the theme is the same: “Steve, how does the UK tax me now that I live here?” And the honest answer is: until recently, the rules were messy. Domicile was vague, subjective, and open to interpretation. It made lon

Steve Thompson

Nov 29, 20254 min read

UK Budget 2025: A Turning Point for British Expats?

Today’s UK Autumn Budget wasn’t dramatic. Today’s UK Autumn Budget wasn’t dramatic for its policies, but it certainly had an unusual start. The Chancellor’s speech was briefly overshadowed by an unprecedented error, when the Office for Budget Responsibility’s analysis was accidentally published early, prompting the Shadow Chancellor to call it “outrageous.” A “pre-Budget Budget” unfolded online before a word was spoken in Parliament, with journalists scrambling to digest the

Steve Thompson

Nov 26, 20256 min read

Atlas Bridge Wealth: Redefining Cross-Border Financial Planning for British Nationals in Portugal

Steve Thompson - Founder & CEO @ Atlas Bridge Wealth November 25, 2025 The story behind why we built Atlas Bridge Wealth Moving to Portugal isn’t simply a lifestyle decision, it’s also a financial one. For many British nationals, the appeal is obvious: year-round sunshine, lower living costs, beautiful coastlines, and a pace of life that feels healthier and more grounded. Yet behind the dream often sits a complex financial reality. The moment you become a Portuguese tax resi

Steve Thompson

Nov 25, 20254 min read

Considering a move from the UK to Portugal?

Consider these points before you leave... By Atlas Bridge Wealth Relocating from the UK to Portugal is an exciting lifestyle decision, but it’s also one of the most significant financial transitions you’ll ever make. The tax systems don’t align neatly, and without the right planning at the right time, many British expats unintentionally create avoidable tax bills, lose valuable allowances, or miss out on opportunities available only before they leave the UK. At Atlas Bridge

Steve Thompson

Nov 23, 20254 min read

Beyond the non-dom era: why your Will should be central to UK wealth planning

Steve Thompson Founder & CEO @ ATLAS BRIDGE WEALTH | Boutique cross-border financial advisory | Europe & Middle East | Chartered Fellow CISI® November 18, 2025 By Atlas Bridge Wealth When the UK formally ended the non-domicile tax regime in April 2025, the change signalled far more than a technical tax reform. It marked the end of a century-old framework that shaped how globally mobile individuals structured their wealth. The UK has now entered a residence-based tax system

Steve Thompson

Nov 18, 20253 min read

Portugal surges ahead as Europe’s most desirable expat destination

By Steve Thompson, Founder & CEO @ ATLAS BRIDGE WEALTH | Boutique cross-border financial advisory | Chartered Fellow CISI® November 15, 2025 An Atlas Bridge Wealth Guide for UK Expats Portugal has firmly established itself as one of Western Europe’s most attractive destinations for individuals and families seeking a fresh start abroad. It has now overtaken Spain as the preferred base for retirees, remote workers, globally mobile professionals, and lifestyle-driven relocators

Steve Thompson

Nov 15, 20254 min read

Living Well, Not Just Long in Portugal

Moving to Portugal is about more than sunshine and scenery, it’s about creating a lifestyle that’s financially sustainable. Whether your income comes from pensions, savings, or investments, the goal isn’t just to make your money last, it’s to make it work for you throughout retirement. Pre-Relocation Planning The best financial planning starts before you pack your bags. Taking advice while still UK-resident can unlock opportunities that disappear once you’ve left, such as

Steve Thompson

Nov 11, 20252 min read

bottom of page